In April 2025, the U.S. government announced an additional 50 percent tariff on Chinese goods, sparking global concern. The move is a continuation of the Trump administration's trade policy toward China and the latest escalation of the U.S.-China trade game. According to the U.S. statement, if China does not withdraw the 34% retaliatory tariffs previously imposed on U.S. goods by April 8, the U.S. will impose 50% additional tariffs on China from April 9, which, when stacked with the 54% tariffs that have been previously implemented, will result in a tax rate of up to 104% on some Chinese goods exported to the United States.

The underlying logic of tariff escalation: from “trade imbalance” to “strategic containment”

2025 On April 9, the additional 50 percent tariffs imposed by the United States on China came into effect, superimposed on the previous rate of 54 percent, and the tax rate on some Chinese goods exported to the United States was as high as 104 percent. This policy is not an isolated incident, but a continuation of the Trump administration's “America First” strategy, behind which lies a triple deep-seated contradiction:

1.Structural imbalance in the economy: the share of manufacturing in the GDP of the United States has declined from 28% in 1953 to 8.4% in 2024, while China's manufacturing value-added accounts for 30% of the global share. This structural imbalance has led the US to blame China for its trade deficit, while ignoring the fundamental problem of hollowing out its own industries.

2.Technological hegemony: The U.S. focuses on more than 1,300 tariff items such as semiconductors and new energy involved in “Made in China 2025,” essentially curbing China's technological upgrading. For example, the tariffs imposed by the US on electric car batteries have directly impacted the global layout of companies such as Ningde Times.

3.Reconstruction of global rules: The U.S. attempts to subvert the WTO multilateral system with “reciprocal tariffs,” but its calculations have been dismissed by the Austrian Institute for Economic Research (AIER) as “haphazard”. This kind of unilateralism has triggered countermeasures by more than 20 countries, including the European Union and Canada, and the global trade rules are facing a change not seen in a century.

104% The Butterfly Effect of Tariffs: From Corporate Pain to Global Tremor

The tariff storm is triggering a chain reaction:

1.Enterprise survival crisis: Yiwu Commodity Market data show that the cost of 3mm acrylic products exported to the U.S. surged by 150%, and some enterprises were forced to give up customers with annual orders of more than 5 million yuan. A furniture factory's annual loss reached 20% due to the 30% extension of the logistics cycle and the decline in capital turnover.

2.Global supply chain reconfiguration: The Peterson Institute predicts that tariffs will increase the cost of the global supply chain by 12%, with countries such as Vietnam and Mexico taking over 15% of China's capacity transfer. However, this “de-Chinaization” has led to a 25% increase in procurement costs for U.S. companies, and the 95% localization rate of Tesla's Shanghai factory proves that China's supply chain is irreplaceable.

3.Consumers suffer: U.S. consumers bear 92 percent of the cost of tariffs, increasing average annual household spending by $1,300. In the automotive industry, for example, the average price of a new car in the U.S. rose by $5,000 after the tariffs on imported parts went into effect, and the price of used cars in the market soared by 30 percent.

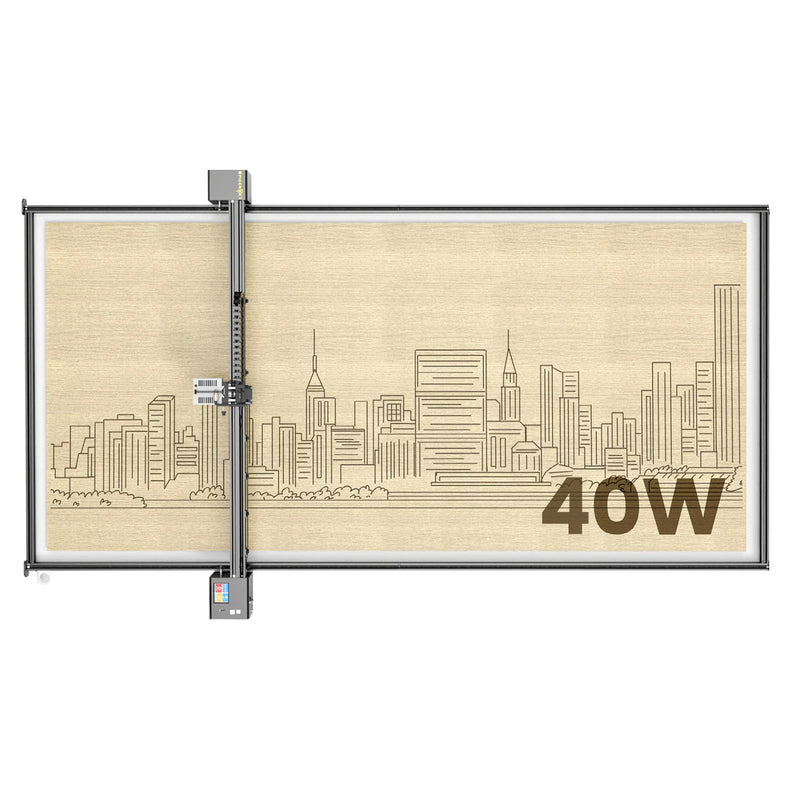

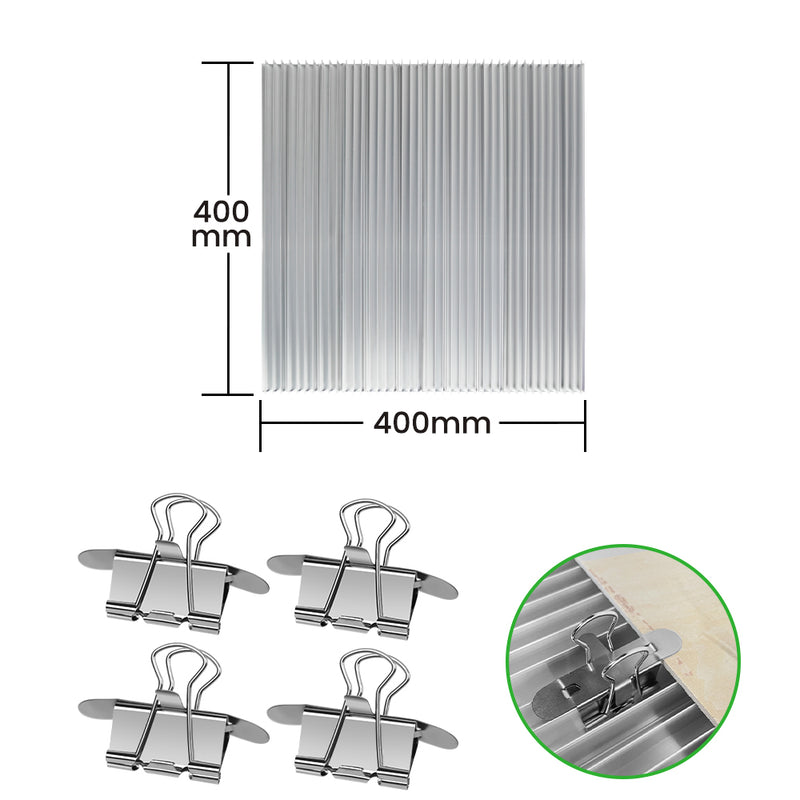

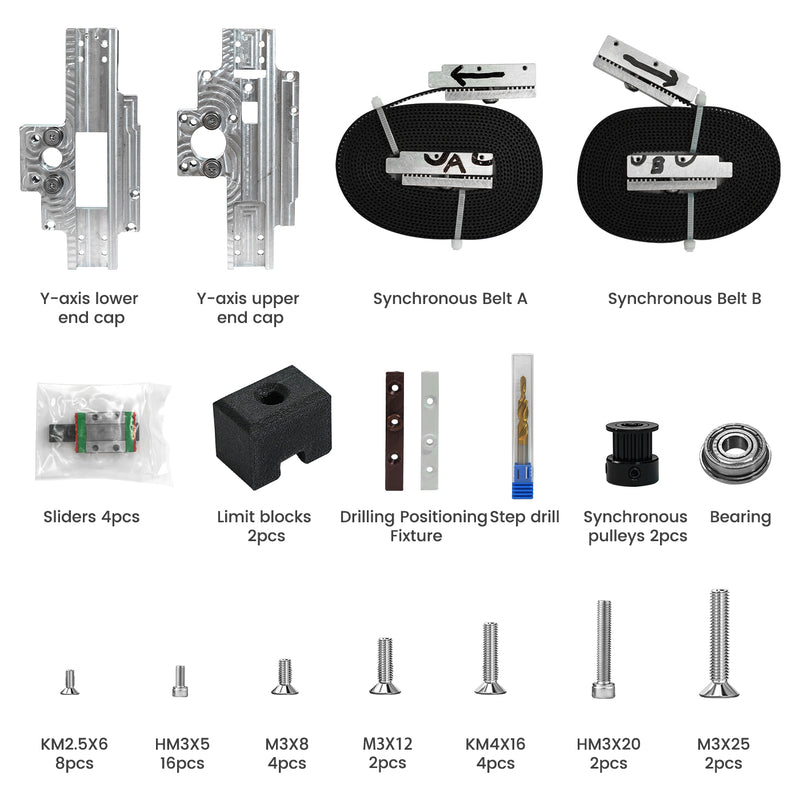

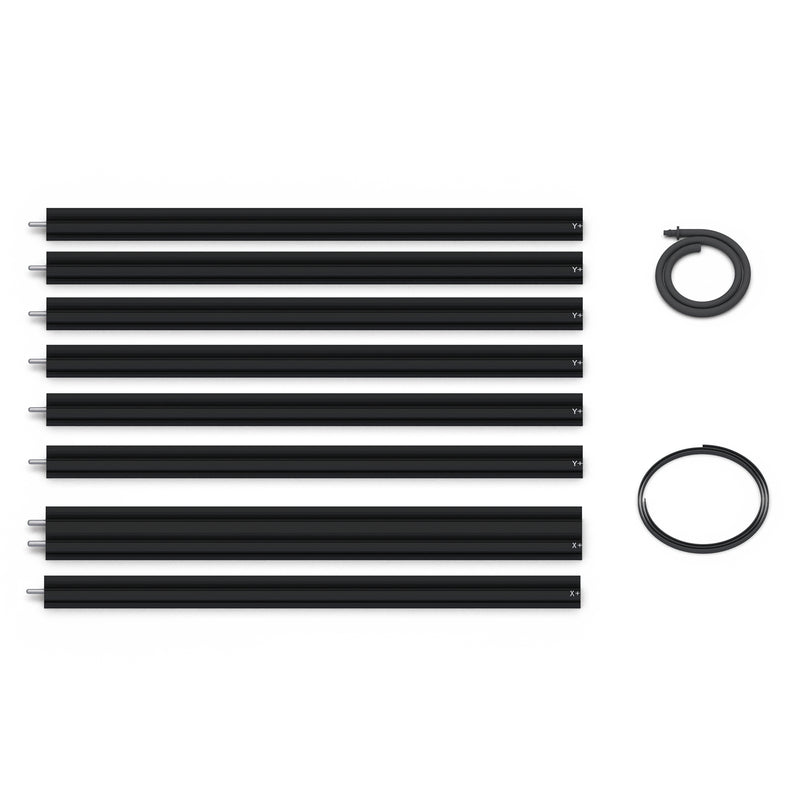

Tyvok's core product Spider S1 series of consumer-grade devices (such as 60W high-power 2-in-1 models) are not included in the list of tax increases, and industrial-grade devices account for less than 5% of the total, to avoid the impact of the policy from the source.

Before December 2024, Tyvok will complete the 3-month stocking in North America to ensure that the supply in the first quarter of 2025 will not be interrupted.

Tyvok has systematically optimized its core components, raw material procurement and cross-border logistics paths, and established a more flexible and efficient supply chain management mechanism, which effectively reduces the overall cost under the premise of guaranteeing the quality and enhances the price competitiveness of its products in the global market.

Tyvok has established localized sales sub-sites and service systems in key regions such as Europe and Southeast Asia.

Countering uncertainty with certainty, Tyvok will work with you in the new cycle of growth.

104% tariff is a challenge, but also an opportunity to reshuffle the industry, Tyvok builds a stable cooperation system for its partners to go through the cycle with the precision of policy adaptation, cost control, and leading technology innovation. By choosing Tyvok, what you get is not only equipment supply, but also a strategic partner with “short-term risk hedging + long-term value symbiosis”.